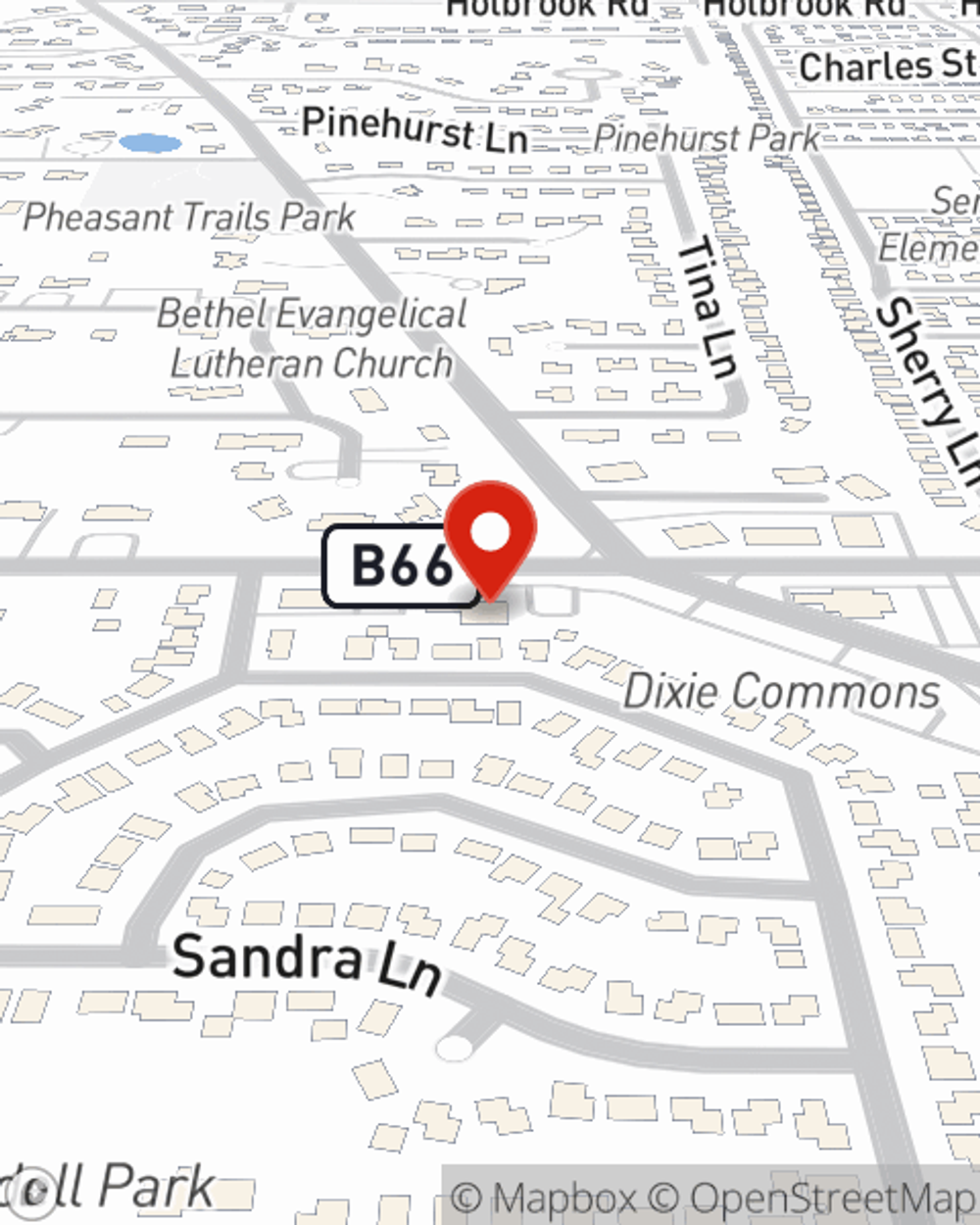

Business Insurance in and around Chicago Heights

Calling all small business owners of Chicago Heights!

Almost 100 years of helping small businesses

This Coverage Is Worth It.

Though you work so hard to ensure otherwise, it is good to recognize that some things are simply out of your control. Problems happen, like a staff member gets hurt on your property.

Calling all small business owners of Chicago Heights!

Almost 100 years of helping small businesses

Protect Your Business With State Farm

The unexpected is, well, unexpected, but that's all the more reason to be prepared. State Farm has a wide range of coverages, like extra liability or business continuity plans, that can be molded to develop a personalized policy to fit your small business's needs. And when the unexpected does occur, agent Derrick Jones can also help you file your claim.

Do what's right for your business, your employees, and your customers by reaching out to State Farm agent Derrick Jones today to identify your business insurance options!

Simple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Derrick Jones

State Farm® Insurance AgentSimple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.